The world has seen a spectre of Coronavirus (COVID-19)! This deadly virus has already affected 2.6m people with a death toll of 185,494 around the world at the time of writing this article. The number of affected in India is more than 21,797 and out of them, 686 have died. We witness an attempt by various governments in India to portray our ‘success’ in terms of containing the pandemic.

For example, it is claimed that we are four times more populous than the United States (US) but the number of cases in India is 2% as compared to the former. Similarly, the number of deaths is only 1.5% with a per-capita income of just a tenth of the US. However, a number of experts have argued that apparently, the low number of COVID-19 cases in the country might possibly be due to limited testing and there are apprehensions that the actual figures of infected people may be much higher.

Pandemic and economic crisis

In the meantime, we are in the second innings of the lockdown. The onset of the pandemic has caused a havoc in the global financial sphere. Since February, the news of an impending crisis couldn’t be contained under the rug. Globally, the share markets have been crashing. A closer look at the situation reveals that we are more vulnerable today as compared to 2007-2008 and the impacts will be long lasting.

Although the pandemic triggered the downfall of the share markets, the economic crisis was brewing for quite long. While the capitalist media and their experts are trying to portray the virus as a villain, responsible for this crisis, it is amply clear that the pandemic only served as a trigger and is not the root cause of the crisis. The financial world was loaded with explosive material which needed a fuse to burst violently.

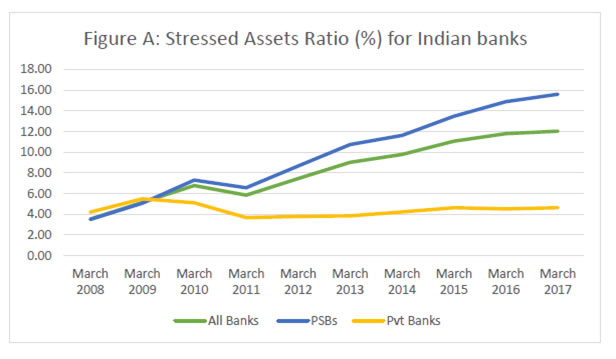

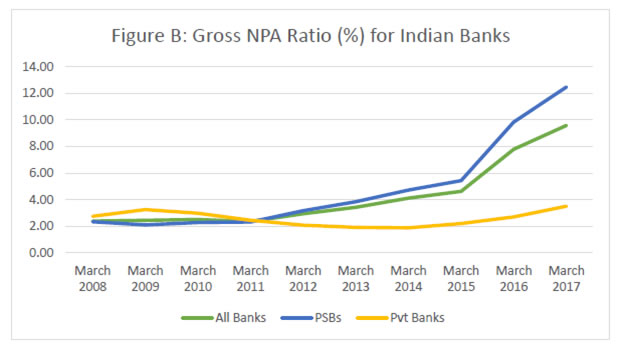

The data and other information for the last few years make it amply clear that the Indian economy was going through a wobbly phase. The banks were saddled with unpaid loans or the non-performing assets (NPAs) and moreover, these were increasing at an alarming rate.

According to the Reserve Bank of India (RBI), the amount of outstanding loans whose value was Rs 500 billion in 2005-2006 has increased to Rs 10.35 trillion in 2019-2020. A 2070% increase in less than 15 years! The table below shows the details of unpaid loans of some of the biggest capitalists in the country.

| Company/Name | Total debt |

|---|---|

| Adani Power Ltd | Rs 373.74 billion |

| Mukesh Ambani | Rs 2.88 trillion |

| DHFL | Rs 420 billion |

| Punit Goenka | Rs 135 billion |

| Subhas Chandra (Zee) | Rs 20 billion |

| Anil Ambani | $680m* |

The banks are struggling due to these huge amounts of debts; it is evident that the unpaid loans would take the country’s economy to a crisis.

| Bank Name | Debt in Rs billion | Debt rate |

|---|---|---|

| Punjab National Bank | 784.73 | 15.5 |

| United Bank of India* | 487.29 | 14.98 |

| Oriental Bank of Commerce* | 217.17 | 12.66 |

| Syndicate Bank* | 246.80 | 11.37 |

| Canara Bank* | 392.24 | 8.83 |

| Allahabad Bank* | 287.05 | 17.55 |

| Indian Bank* | 82.00 | 7.37 |

| Andhra Bank | 90.91 | 16.21 |

| Corporation Bank | 207.24 | 15.35 |

| Union Bank of India | 487.29 | 14.98 |

* These banks are now merged.

The issue is not merely limited to the conditions of the banks. The rate of unemployment is accelerating day by day. The data released by NSSO in May-June 2019 revealed that the rate of unemployment was 6.1 %, the maximum in the last 45 years. According to the Centre for Monitoring Indian Economy (CMIE), the unemployment rate has shot up to more than 24% during the lockdown weeks of March and April 2020. The CMIE data shows that unemployment is at an all-time-high 23.8% at the time of writing this article.

The issue of farmers’ suicide due to debt also indicates the failure of the government in containing the agricultural crisis. The automobile industry suffered immensely due to low demand in the last fiscal year which affected sales and the production of cars fell significantly. The real estate and other sectors have a similar story of suffering as well. All these points towards an impending crisis of the Indian economy.

While several commentators had pointed out towards this bleak scenario for quite some time, the popular opinion was diverted by pointing out at the exuberance in the share markets and its incessant growth. This exuberance was used by the ruling classes to exhibit the ‘excellent health’ of our jet-set economy. The peddled dream of a US$5 trillion economy by 2025 with a combined dose of an aggressive brand of communal politics led people to believe that the current dispensation and especially, its supreme leader, Prime Minister Narendra Modi, is invincible.

Fictitious capital and real economy

However, economic reality cannot be fully understood through the prism of the share market. In the last few years, the fictitious capital in the Indian economy has increased exponentially. On January 1st 2011, the benchmark index, the BSE Sensex was at 20509.09 points, travelling to 22986.12 points on February 2nd 2016; consequently, it was at 41,464.41 points on January 3rd 2020. The phenomenal growth of 200 % in less than four years!

The increase and the disappearance of this fictitious capital spell disasters in the long run since its character is quite different as compared to productive capital. Fictitious capital very little links with production or the direct exploitation of human labour or nature. In every crisis, a part of this capital has to disappear. The crisis in the share market results from the huge gap between two types of capital: fictitious and real.

As the French economist, Jean-Marie Harribey says: “Bubbles burst when the gap between realized value and promised value becomes too great and some speculators understand that promises of profitable liquidation cannot be honoured for all, in other words, when financial capital gains can never be realized for the lack of sufficient surplus value in production.”

Big capital and speculators, also known as smart money in the share market parlance, realise this before others and try offloading their shares bought at a much cheaper price during the period of boom. There have been similar crashes in recent history. The collapse of the share market in 1992, the East Asian crisis of 1997, the dotcom bubble collapse in 2000, the sub-prime crisis in 2007-2008 and finally the Dollar Price Crisis.

The crisis of the speculative market was a matter of time and the COVID-19 pandemic became a trigger and not the cause. This dubious explanation of putting all the blames on the shoulders of the pandemic is a clever trick designed to divert people’s attention from the role played by policies in the interest of big business on a planetary scale and the complicity of the governments in place.

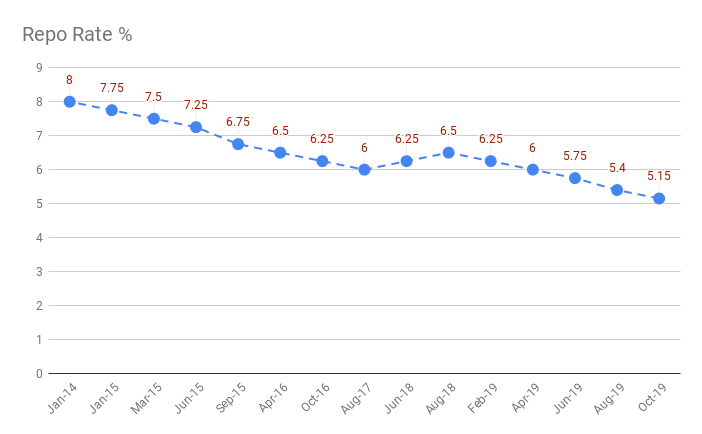

In reality, the exuberance in the share market was created with the government and the RBI playing a big supporting role. In the last few years, the repo rate was slashed several times. The repo refers to a mechanism by which banks finance themselves for a short period of time: they sell (repo) securities that they own and commit to repurchase them quickly. As a result of this, cheaper loans were available at cheaper rates, which was used to the hilt by corporates to buy shares and even buy back their own shares.

The obvious question that comes to the reader’s mind is who bought the shares? The share markets are controlled by a handful of organisations that constitute less than or equal to 0.1 % of the entire society. Taking advantage of the withdrawal of capital controls or the mobility of capital, global funds flocked into the country which entered the speculative market.

Large Foreign Institutional Investors (FII) that operate in India are Euro Pacific Growth Fund, Government of Singapore, Oppenheimer, Abu Dhabi Investment Authority, government pension funds, Global First State Investment and many more. Besides these, there are Domestic Institutional Investors (DII) who reign over the share markets like the Housing Department Finance Corporation Limited, Shriram Transport Finance Company Limited, Bajaj Consumer Care Limited, Fortis Health Care Limited, Small Finance Bank Limited and 30 other organisations. Apart from these, there are some banks like Axis Bank, HDFC Bank and several pension funds. The LIC is also a big player in the market.

In 2020, these institutions, realising that the bubble was going to burst soon took the opportunity of the excitement in the share market and sold the shares at a price much higher than their cost price. Naturally, they could profit enormously by these sales. Following the trend, many other big players and speculators followed suit before the price fell, and received good profit triggering a collapse.

It has been seen that the companies that took advantage of this situation, suddenly had their asset value decreased since the collapse of the market also impacted the rest of the shares they were holding. Between January 17th and March 24th 2020, the wealth worth Rs 52 trillion vanished in the complicated web of share market. This is approximately 40% more than our GDP. More than seven times or 700 % of the planned deficit of the national budget.

Whither Indian economy

The continuous financial crisis points to the fragile health of the Indian economy. In order to save the big capital from this crisis the RBI, on March 18th, announced that it wishes to buy corporate bonds and, through this, infuse Rs 100 billion of liquidity in the market. It has also decided to reduce the repo rate by 75 basis points and encourage people to take loans and have plans to infuse Rs. 3.74 trillion of liquidity into the Indian banking system as it vowed to do whatever it takes to support financial markets hit by the spread of the pandemic. This approach could only stabilise the share market for a very limited time and ultimately the collapse continued. On March 16th, around 8% capital got wiped out in the intricate web of the speculative world.

The measures expose the class-bias of the fight against the pandemic. The steps were intended to protect the interest of 1% of the society since between February 12th and March 17th, the BSE lost 25.5 % of its value. However, the rescue funds rolled out to protect the interests of big capital either came from people’s savings or the taxes paid through their hard-earned money. In the name of saving the economy, the authorities are using people’s money to protect the interests of a handful of Indian super-rich while hundreds of thousands of migrant workers are left without the basic means of survival. Millions of workers, especially in the unorganised sector, face an uncertain future.

This plunder is carried out by the Troika of the government, banks, and corporate houses and will certainly exacerbate class differences in the society. The upper classes will have enormous riches while millions will languish in terrible poverty and unemployment. Karl Marx’s observation about the fragile capitalist system “Accumulation of wealth at one pole is at the same time of accumulation of misery, agony of toil, slavery, ignorance, brutality mental degradation at the opposite pole.” is more relevant than ever.

What’s next?

The Indian capitalists played a big role in Modi’s coronation in 2014 and reposed their faith once again, in 2019. In spite of the utter failures and a series of anti-people policies in his first innings, Modi was nevertheless, the darling of the corporate-controlled media and big capital in the 2019 general elections. After winning the last parliamentary elections, it brought open its aggressive brand of Hinduvta fascism, creating a deep communal polarisation in the society.

Many have been upset at the way this government bulldozed dissenting voices and implemented a new citizenship matrix, abrogated Article 370 in Kashmir, etc. Never could a lot of progressives imagine in the past that the far-right can entrench in the society to such an extent, debasing the society and degrading humane values in the process. The COVID-19 pandemic and the financial crisis has the potential to create chinks in its armours provided we are able to live up to the task.

However, economic instability alone is insufficient to change the society and we need to rock the political structure that begets it. We have a chance to fight fascism effectively if we are capable of channelizing popular anger and discontent caused due to the impacts of the pandemic and the government’s utter disregard of common people’s interests. To achieve that we need to strive hard to organise and unite the toilers of the society around the questions of their survival.

An avid reader and a leftist. Believes in socialism and a merciless critique of capitalism. Writes columns on politics, economy and society.