Tag: debt waiver of PSU Banks

PSBs gift corporates freedom from debts worth Rs 4.37 trillion during 2018-20

India’s public sector banks collectively wrote-off Rs 4.37 trillion-worth non-performing assets between April 2018 and December 2020, benefitting corporates.

Rakesh Jhunjhunwala, the share market’s prospects and IBC’s failure

Rakesh Jhunjhunwala asserted that investors shouldn’t be swayed by the inflation. Given the worsening NPA situation of the PSBs, can the markets stay safe?

Privatisation: A doomed attempt to provide oxygen to crisis-ridden capitalism

The privatisation of public sector undertakings by the Modi regime is a frantic attempt to revive crisis-ridden capitalism with free oxygen. It won’t help.

Resist public sector bank privatisation through mergers to save the economy

Nirmala Sitharaman’s decision to merge 10 public sector banks into four big banks is actually a step towards their privatisation, which must be resisted.

Resistance to Modi’s “big bang reform” plan is imperative to save the poor and India

Modi’s attempt to sell off India, its resources and labour to foreign and domestic corporations under the garb of “big bang reforms” must be resisted by all

Cat to Guard Fish: Assocham Demand of PSU Bank Privatisation

It’s not yet a week that the ₹11,400 crore worth PNB scam involving Nirav Modi and Mehul Choksi, two close aides of the Narendra Modi-led BJP government, became public, Assocham, […]

The Jewel Thief: Analysing the PNB Scam by Nirav Modi & Co.

Last week, a shocked India confronted a gigantic banking scam, unprecedented in terms of magnitude and methods employed. A big comprador and crony capitalist, Nirav Modi, who owns a large […]

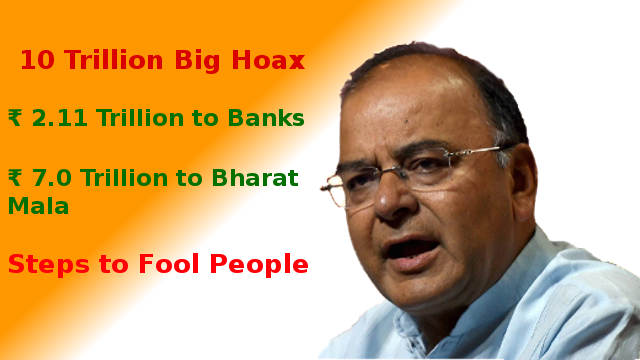

Arun Jaitley Made ₹10 Trillion Worth Hoax Promise

Narendra Modi government announced a ₹10 trillion investment to revive the economy, out of which ₹7 trillion will be spent in building infrastructure, especially 83,677 km of roads and highways […]